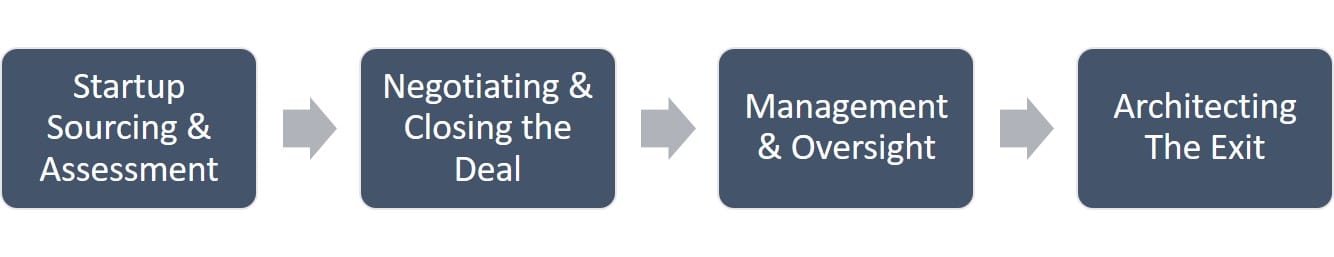

First-time angel investors often start with a perception that startup investments are like what they see on Shark Tank. Reality couldn’t be further from it. Lifecycle of a startup investment, from sourcing and investing to securing the exit, involves an extensive process – a journey of 3-5 years.

Here’s a quick brief on all the activities performed by Ecosystem Ventures team:

A. Startup Sourcing & Assessment

- The journey starts with building and nurturing an extensive network of startup founders, VCs, advisors and corporate leaders that readily make introductions to accomplished founders looking to raise capital. The best deals often don’t make it to a large audience. Our pedigree, experience and previous deals have helped us establish a curated pipeline of startups.

- Assessing the fitment of a startup with our investment thesis is again an extensive exercise, often taking several weeks of dedicated time to analyze the venture. We employ a data-driven decision-making methodology, employing scorecards and checklists to evaluate startups based on various crucial factors, such as:

- Team: Consideration of experience, execution ability, and founder’s risk involved.

- Market: Evaluation of market size, sentiment, and competition.

- Business Model: Assessment of the revenue model and scalability.

- Product: Analysis of the phase of development.

- Thorough Due-diligence: Conducting comprehensive assessments of operations, financials, and systems.

- Traction: Examination of MRR (Monthly Recurring Revenue), ARR (Annual Recurring Revenue), and revenue growth rate.

- Typically such extensive analysis and due diligence is done at a much high level of funding (Series A and beyond), but we over-invest in analysis to ensure a tighter control on investment quality

B. Negotiating & Closing the Deal

- Once we have made an in-principle decision to invest in a startup, we conduct a second round of deep-drive into the financials – both historical and projected. There are a large number of metrics that we analyze, and these metrics vary by industry, business model and stage of the venture. The detailed financial analysis allows us to ascertain valuation that we consider is fair and will provide sufficient upside to us as investors.

- We draft the terms of investment (Term Sheet) that captures valuation and other key terms that would be relevant specifically for the selected startup. In most of our investments, we “lead the term sheet”. This means that other institutional investors / funds etc. would also co-invest based on terms defined by us.

- We negotiate the terms with the founders on various fronts, including potentially contentious terms like founder salaries, information rights, ROFR, anti-dilution, min IRR etc.

- After signing of the Term-Sheet, we initiate formal FDD (financial due-diligence) and LDD (legal due-diligence). Simultaneously, our legal team starts drafting SHA (Shareholders Agreement)

- A shareholders agreement (SHA) is typically a 40-60 page document that captures detailed terms of investment, including positive and negative covenants, steps for enforcement of all investor rights along with provisions for dispute resolution. Many terms are discussed and negotiated between ESV and the founders to arrive at the final SHA for signing.

- Representing the interests of the investors, ESV signs on the SHA and the investment capital is transferred to the startup

- In the SHA, there are ‘Conditions Subsequent’ (CS) : a series of steps to be followed by the startup to complete the deal. We track the completion of CS to bring 100% closure to the investment.

C. Management & Oversight

- While the first two steps (A & B) above are focused on ‘making the investment’, a large part of our role is to actively manage the investment, and oversee the progress of the startup on a regular basis.

- We actively engage in Monthly Business Reviews (MBRs) and Quarterly Business Reviews (QBRs), participating in discussions, offering insights and raising concerns as may be necessary

- We also monitor the utilization of funds by the startup in order to keep their focus on growth and push for fiscal discipline within the startup.

- As the company goes through follow-on rounds of fund-raise through other investors or funds, we ensure that our rights are retained and changes in SHA are not detrimental to our interests. This also often entails further rounds of negotiations with founders and new investors.

- We continue to keep our angel investors informed about the developments in their portfolio companies.

D. Architecting The Exit

- This is perhaps one of the most crucial steps to ensure that we are able to get our investment capital and returns back

- Typically there may be multiple opportunities to exit via secondary sale as the valuation increases and new investors fund the company for growth.

- Assessing the risk-reward equation at various junctures, we decide how and when to take the exit.

- There is a ‘mandatory exit’ clause in all our SHAs that get triggered in 4-5 years, in case we haven’t secured an exit by then. It forces the founder to work closely with us to get an exit through a secondary sale to a fund or a strategic buyer.

Once the exit is complete, we get the money back in the fund scheme, from where the fund is distributed between the investor and the fund manager. We ensure that all the documentation required by our investors for filing their tax returns are provided to them.