Ecosystem Weekly | 01st Aug’21

Byju’s continues acquisition spree, acquires Toppr and Great Learning

Byju’s continues acquisition spree, acquires Toppr and Great Learning

Edtech unicorn and India’s most valuable startup Byju’s is continuing its acquisition spree by buying after-school learning app Toppr and upskilling platform Great Learning in a cash and stock deal.

Read More

Moj, ShareChat owner raises $145M at $2.8B valuation from Temasek, others

Moj, ShareChat owner raises $145M at $2.8B valuation from Temasek, others

Mohalla Tech, the parent company behind Moj and ShareChat, has raised $145 million as an extension of its Series F round. The investment has been led by Singapore state investor Temasek, Moore Strategic Ventures (MSV), along with participation from Mirae-Naver Asia Growth fund.

Read More

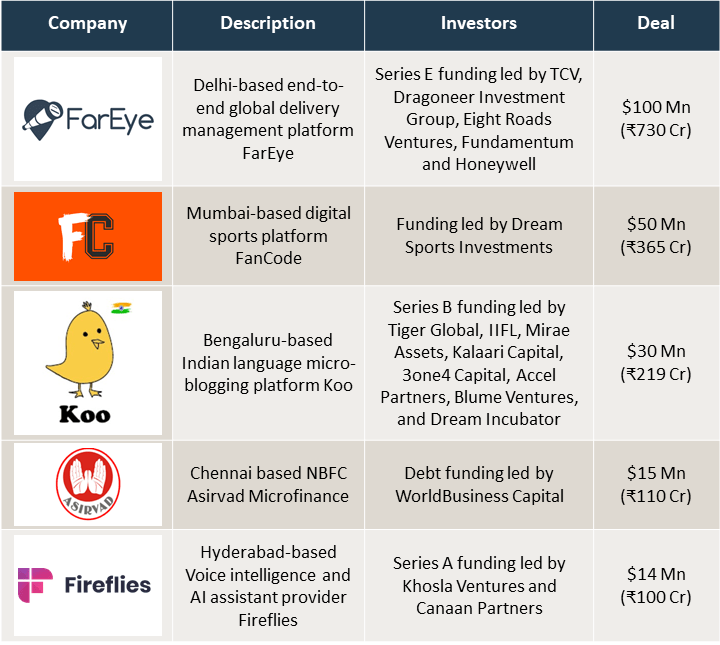

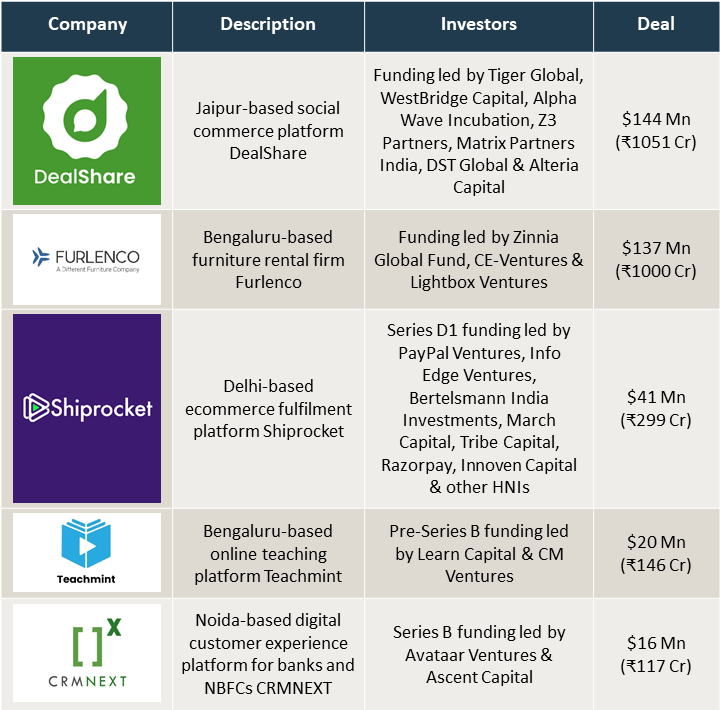

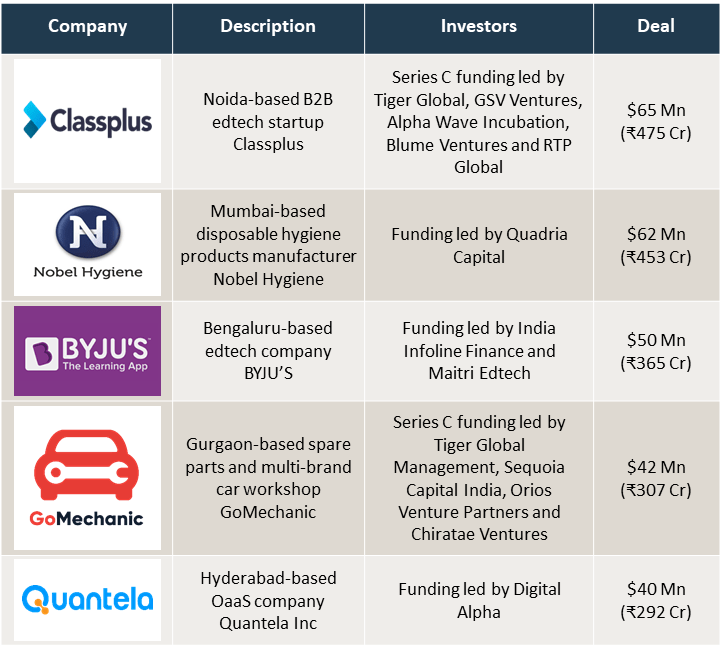

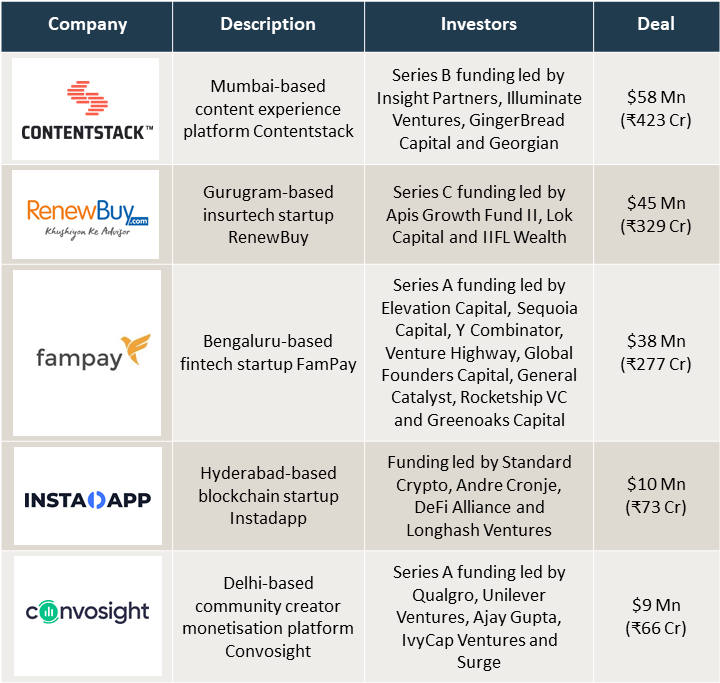

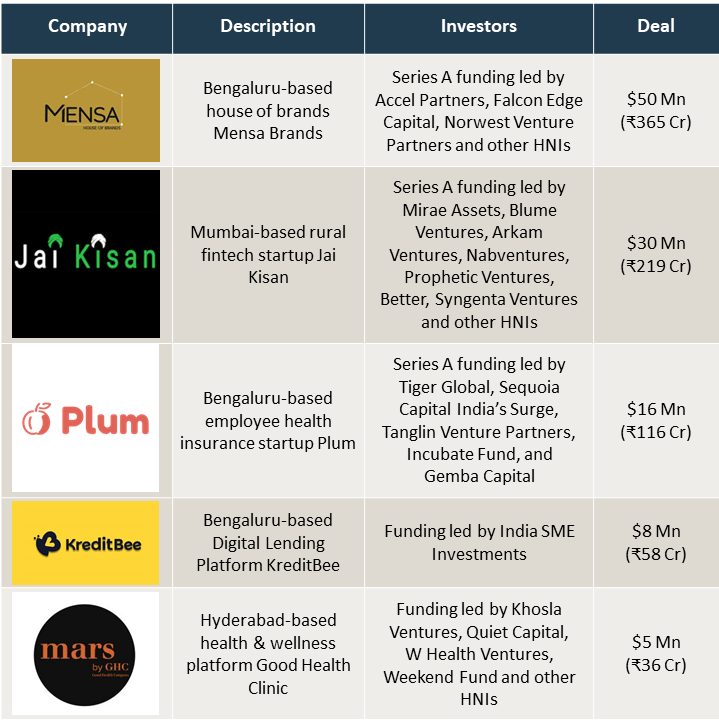

Startup News Snippets

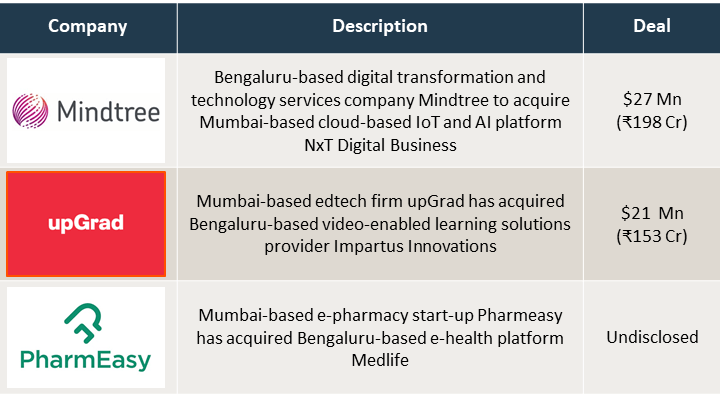

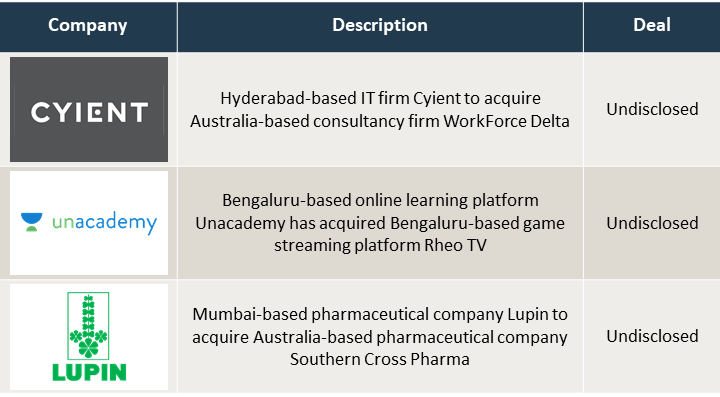

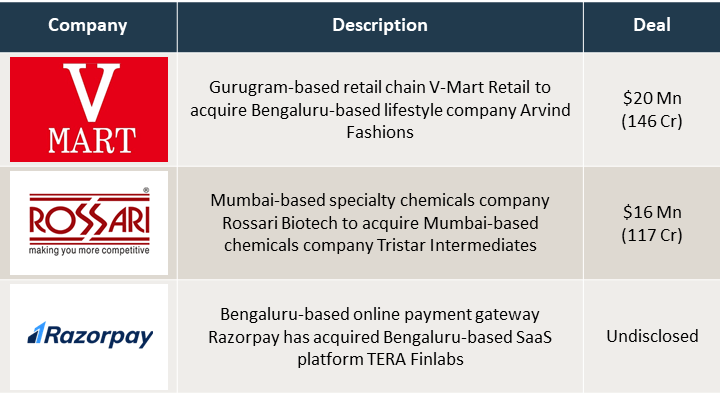

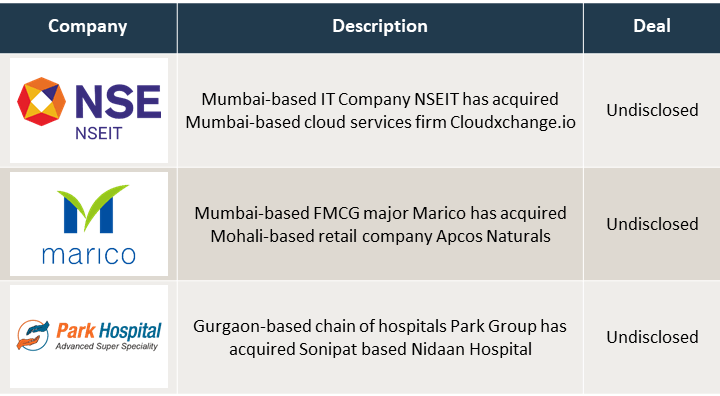

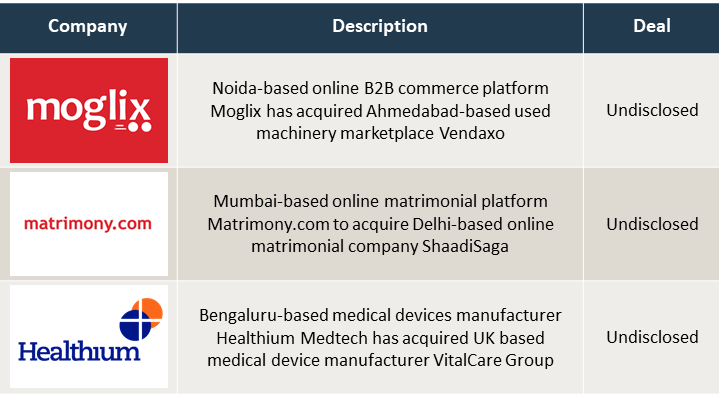

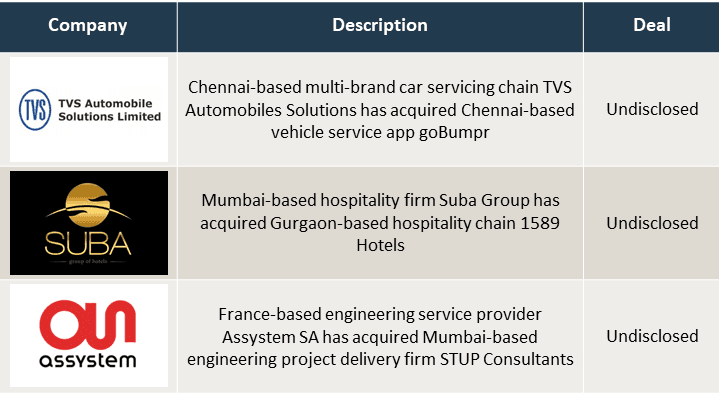

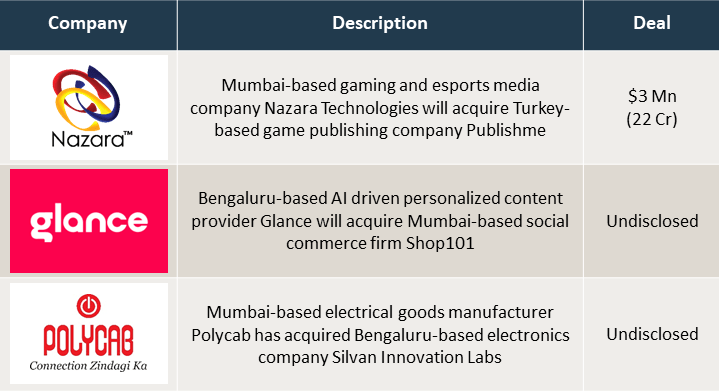

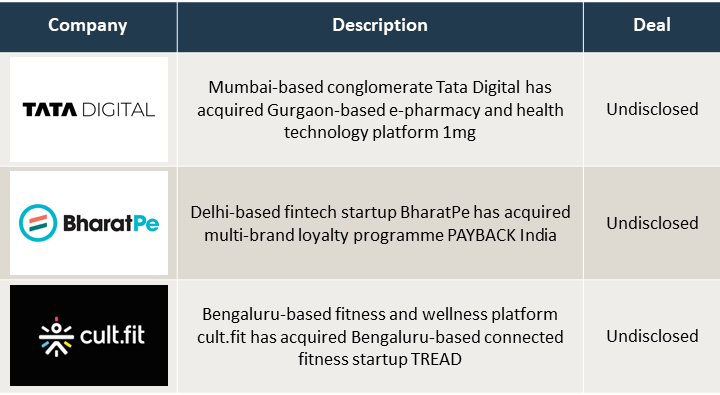

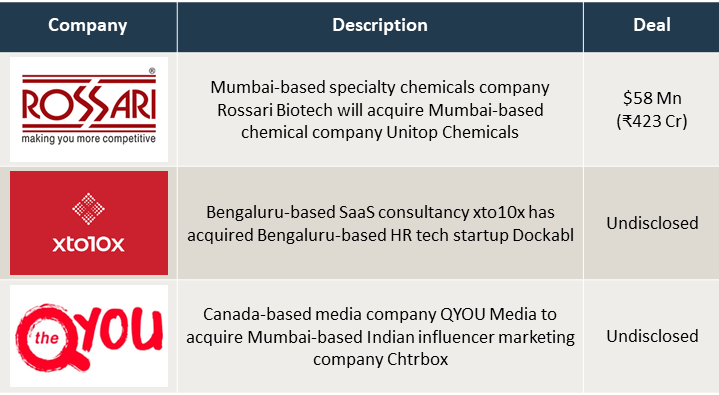

M&A News

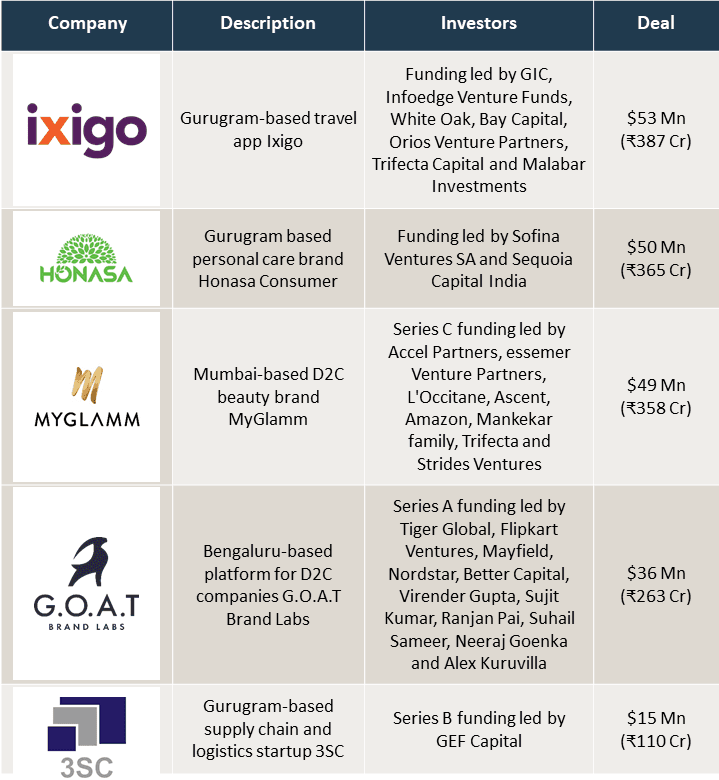

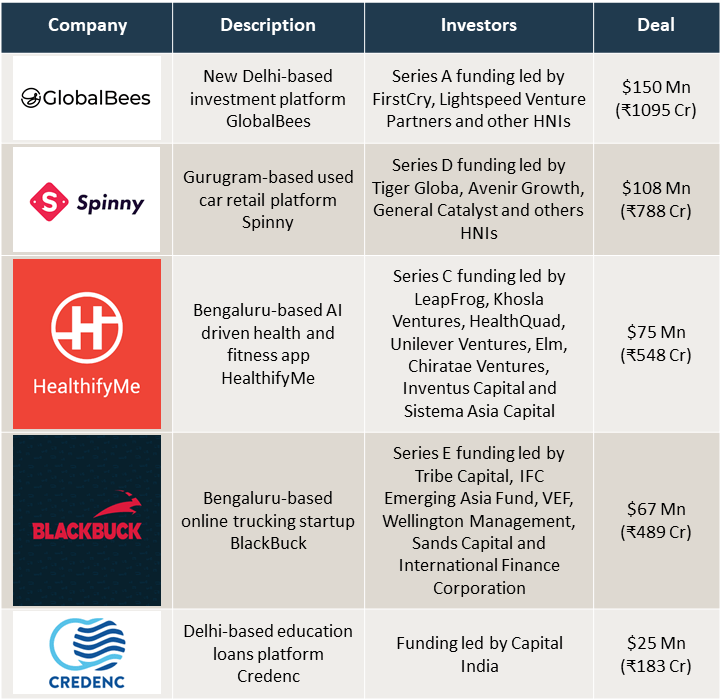

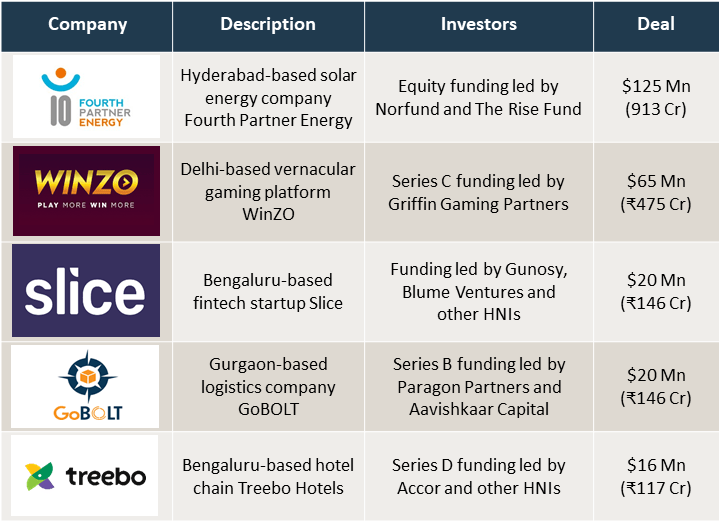

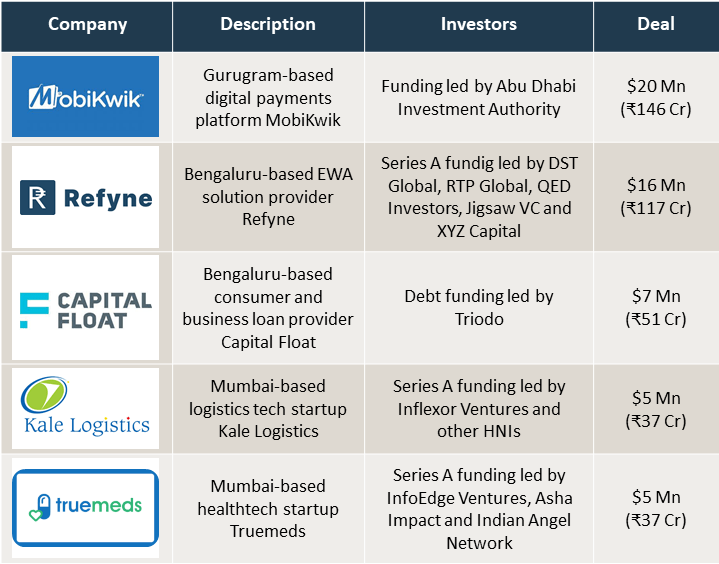

Market Pulse

- Mumbai-based mortgage finance startup Easy has raised $15 million in Series A funding from Xponentia Capital Partners, Harbourfront Capital, Finsight VC, RaSa Future Fund, Navida Capital AB, Helena Wasserman Eriksson and Integra Software

- Jaipur-based skincare brand Minimalist has raised $15 million in Series A funding from Sequoia Capital India and Unilever Ventures

- Bengaluru-based fintech startup Slice has raised $10 million in debt funding from Northern Arc Capital, Niyogin Fintech Limited, Credit Saison India and Vivriti Capital

- Bengaluru-based real-estate investment startup Strata has raised $6 million in Series A funding from Kotak Investment Advisors Limited, Gruhas Proptech, Sabre Investments, Elevation Capital, Mayfield India and Gemba Capital

- Mumbai-based clean-label food brand The Whole Truth has raised $6 million in Series A funding from Sequoia Capital India, Matrix Partners India, Sauce.Vc, Kalyan Krishnamurthy, Sujeet Kumar, Ashneer Grover and Shashvat Nakrani

Byju’s acquires US-based reading platform Epic for $500 mn

Byju’s acquires US-based reading platform Epic for $500 mn Lenskart raises $220M led by Temasek and Falcon Edge

Lenskart raises $220M led by Temasek and Falcon Edge

OYO raises $660M term loan funding from institutional investors

OYO raises $660M term loan funding from institutional investors Reliance Retail to acquire 66.95% stake in Just Dial for $469 mn

Reliance Retail to acquire 66.95% stake in Just Dial for $469 mn

Fintech platform Pine Labs announces $600M round led by Fidelity and BlackRock

Fintech platform Pine Labs announces $600M round led by Fidelity and BlackRock MTG acquires India-based PlaySimple; Chiratae, Elevation Capital exit

MTG acquires India-based PlaySimple; Chiratae, Elevation Capital exit

EdTech platform Saarthi Pedagogy to empower Indian schools with Rs 7 crore of fresh funding led by Ecosystem Ventures

EdTech platform Saarthi Pedagogy to empower Indian schools with Rs 7 crore of fresh funding led by Ecosystem Ventures Licious raises $192M in Series F round led by Temasek and Multiples PE

Licious raises $192M in Series F round led by Temasek and Multiples PE

Temasek, TPG Growth backed PharmEasy to buy listed diagnostics firm Thyrocare

Temasek, TPG Growth backed PharmEasy to buy listed diagnostics firm Thyrocare Piramal Pharma’s contract division completes acquisition of Hemmo

Piramal Pharma’s contract division completes acquisition of Hemmo

BYJU’S surpasses Paytm to be India’s most valuable startup after raising $350M

BYJU’S surpasses Paytm to be India’s most valuable startup after raising $350M Apna raises $70M in Series B round led by Insight Partners and Tiger Global

Apna raises $70M in Series B round led by Insight Partners and Tiger Global

Tiger Global leads $35 Mn round in GoMechanic

Tiger Global leads $35 Mn round in GoMechanic

Logistics startup Delhivery raises $275M in Series H round led by Fidelity Management and Research Company

Logistics startup Delhivery raises $275M in Series H round led by Fidelity Management and Research Company Urban Company raises $255M in Series F round at $2.1B valuation

Urban Company raises $255M in Series F round at $2.1B valuation

Tata Buys Majority Stake in BigBasket, to Compete Against Amazon, Flipkart

Tata Buys Majority Stake in BigBasket, to Compete Against Amazon, Flipkart