Foraging Finfluencers

We are evolutionarily programmed to be lazy. We would rather spend the least amount of mental effort and expect maximum output in return. This could be one of the reasons for our fascination with schemes or claims promising quick money in no time.

This age-old human weakness is exploited in newer ways by enterprising individuals. The latest being the rise of the tribe of ‘Finfluencers’.

Influencer is a person who commands a sizable audience on social media platforms, and makes money through monetising his large follower base through affiliate marketing & brand collaborations with companies. While influencers generally operate in segments such as beauty or lifestyle, finfluencers operate in a very niche area — finance. They offer unauthorized financial advice and tips, on a range of topics such as stock market trading, personal finance, and mutual funds.

Finfluencers make the boring and complex jargons of finance relatable through their engaging content. In this way, they can be credible enablers of financial education in a country where financial literacy is estimated to be ~27%. But they have been in the news for all the wrong reasons.

SEBI on May 25 penalised and barred popular youtuber and options trader Mr PR Sundar from trading for a year over alleged violation of investment adviser’s norms. There have been reports, since last November, that SEBI would formalise rules for this growing group of financial influencers, with SEBI chairman Ms Buch, cryptically acknowledging the same at an event related to the Mutual Fund industry.

Contrary to Registered Investment Advisors (RIA) who are regulated by SEBI to safeguard investor interests, finfluencers aren’t in the regulatory ambit yet. There exists a clear conflict of interest and public risk. Conflict arises as finfluencers typically have revenue sharing arrangements with the stock brokers or fintech companies with whom they have an affiliate relationship. Thus, their advice, wrapped in the package of engaging content, may not be objective.

Nehal Mohta, founder of Finnovate Financial Services, summed up the inherent public risk succinctly –

Money and health are two areas of our life that have a lot in common. In both, the gap between what we know and what the experienced practitioners know is very vast.

Finfluencers are to financial advice what health websites are to managing illness. They are good to consume as long as one is not treating oneself based on the advice one receives online,

Suggestions on regulating finfluencers include creation of a self-regulatory body or by setting up a standard operating procedure (SOP) for financial content creation and distribution.

Social media, by design, doesn’t have a barrier to entry. This further complicates the issue around regulation as lifestyle influencers, not finfluencers, have been increasingly found to indulge in affiliate marketing and collaboration with trading platforms, reproducing the platform’s sales script without acknowledging their vested interests and risks involved for the viewers.

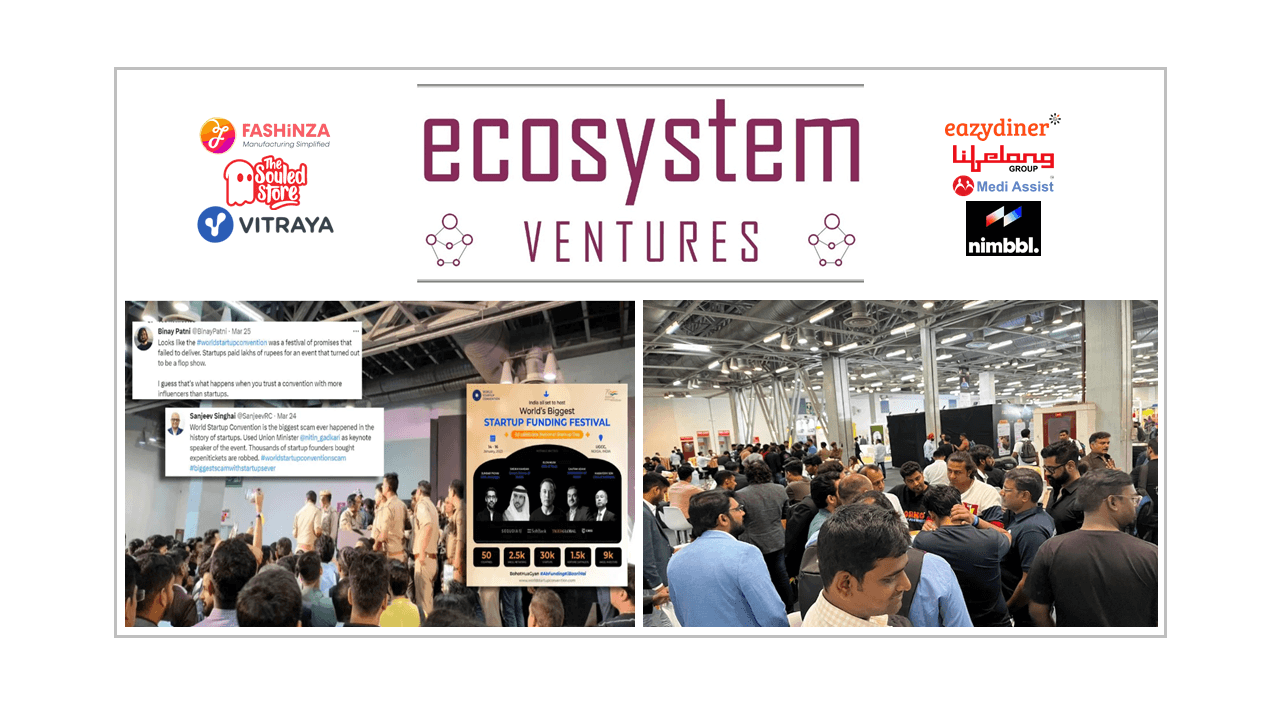

Perhaps a similar trend has emerged in the startup ecosystem as well, where articulate self-styled content creators often end up misleading people on startups, for want of likes and views.

At ESV, we pride ourselves on our due diligence, where every startup which comes to us, is evaluated meticulously on its merits, before being shared with you.

It is a slow and a grueling process, but it is effective.

Ecosystem Ventures This Week

We are happy to share that Mr. Shailesh Jain (Partner, Ecosystem Ventures) has participated in a panel discussion on “Opportunity for startup in Central India and perspective toward funding” at WIRC OF ICSI event, held in Indore.

Startup Funding Summary

CleanMax, Mumbai-based renewable energy company, has raised $360 Mn in a funding from Brookfield Renewable – Read More

Atomberg Technology, Mumbai-based consumer appliances brand, has raised $86 Mn in Series C funding from Temasek, Steadview Capital, Trifecta Capital, Jungle Ventures and Inflexor Ventures – Read More

Pixxel, Bengaluru-based spacetech startup, has raised $36 Mn in a funding from Google, Radical Ventures, Lightspeed Venture Partners, Blume Ventures, growX, Sparta, and Athera Venture Partners – Read More

NewTrance, Bengaluru-based climate technology startup, has raised $6 Mn in a funding from Sequoia Capital India, Aavishkaar Capital, Speciale Invest, Micelio Fund, Ashish Goel and IKP Knowledge Park – Read More

KarmaLife, Bengaluru-based fintech startup, has raised $6 Mn in Pre-Series A funding from Krishna Bhupal’s family office, Artha Venture Fund, Net Graph Investments, Singularity Ventures, LogX Venture Partners, Balesh Sharma, Amit Jain, Vikram Kailas and Shaji Kumar Devakar – Read More

M&A Snippets

Mumbai-based proptech platform Aurum PropTech has acquired Bengaluru-based online home rental startup NestAway Technologies for $11 Mn – Read More