Ecosystem Weekly | 10th July’22

Human civilization is contingent on transactions. Since the dawn of commerce, markets are the avenues for facilitating transactions between buyers and sellers. For centuries, offline markets have dominated commerce, but they are limited by geographical proximity and space constraints of the two transacting parties. Online markets are not restricted in the same way. Hence they are scalable. But how do merchants receive payments from the customers in the online world?

Banks through their net banking was the obvious first answer. But in the last decade numerous fintech companies, such as Razorpay, PayTM, have emerged to simplify purchases for the online merchants. Banks in their traditional sense are not designed for processing payments. They are meant to take deposits and deploy credit where it is needed.

These intermediaries facilitating transactions between merchants and customers would now be referred to as licensed ‘Payment Aggregators (PA)’. In simple terms, there are two components in facilitating a transaction – managing funds & enabling technology to talk to different machines (servers) to debit and credit the right amount of funds from the correct set of accounts.

Reserve Bank of India, in Mar 2020, had mandated that only those companies who have acquired ‘Payment Aggregator’ (PA) license through them are eligible to provide payment services.

To ensure credibility, resist monopolies, and evolve an emerging market framework, RBI stipulated mandatory capital requirements. The PAs need a minimum net worth of Rs 15 Cr by the end FY 21, which would increase to, and be maintained at Rs 25 Cr after the end of March 2023.

The guidelines further strengthen the KYC norms, merchant creditworthiness & onboarding norms, account settlement processes, fraud prevention & risk management framework, customer grievance redressal mechanism.

Consequently, close to 165 NBFCs had applied for the PA licenses. The day before, it was reported that RBI has in-principle approved applications of Pine labs and Razorpay.

Although the full list of approved PAs is awaited, it appears RBI is stringent with the norms, as this report suggests central bank declining a large number of applications. Non issuance is being attributed to scrutiny for KYC-related issues, past participation with cryptocurrency exchanges and gaming apps, as well as non-compliance with the net worth criteria mentioned before.

With global success of the UPI, the latest directive emphasizing on account aggregator framework for public sector banks and the evolving ONDC protocol, the Indian fintech and ecommerce ecosystem is as vibrant as ever.

Ecosystem Ventures This Week

Key Highlights – Clients

We are happy to onboard a Bangalore-based pharmaceutical manufacturing company.

It focuses on development and manufacturing of IP-led niche finished dosage formulations. It is also among the world’s largest manufacturers of soft gelatin capsules. The Company has a dedicated R&D facility in India with global filing capabilities and a strong footprint across 100 countries.

We look forward to working with them and wish them all the best for a bright future.

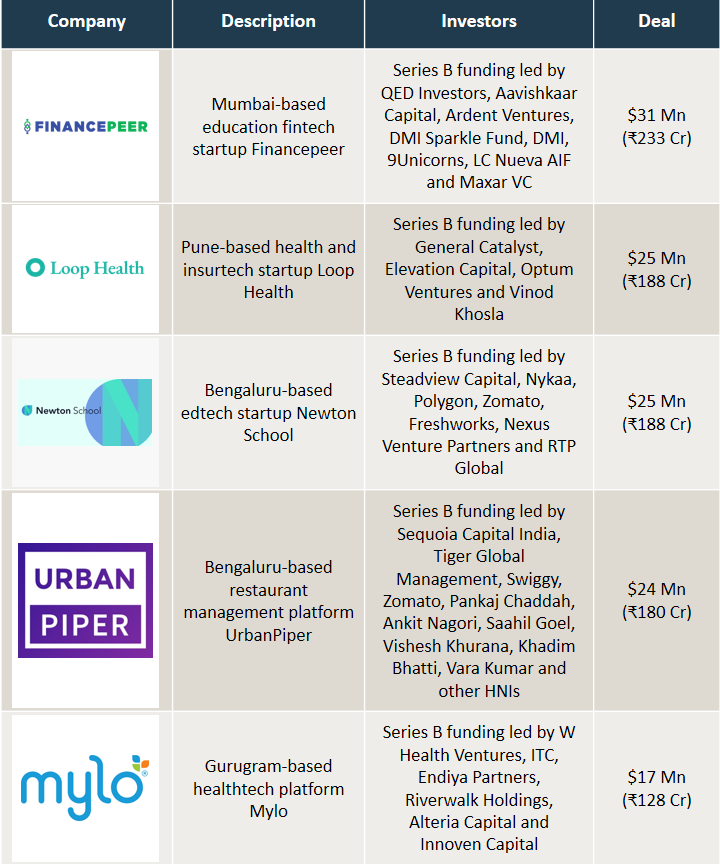

Startup Funding Summary

Innoviti Payment, a Bengaluru-based fintech startup, has raised $15 Mn in Series D funding from Panthera Growth Partners, Alumni Ventures, Patni Family Office, FMO and Bessemer Venture Partners – Read More

MarketWolf, Mumbai-based fintech startup, has raised $10 Mn in series A funding from Jungle Ventures, Dream Capital, iSeed, 9Unicorns, Crescent and Riverwal – Read More

AntWalk, a Bengaluru-based edtech startup, has raised $8 Mn in Series A funding from GSV, Y Combinator and Matrix Partners India – Read More

Acefour Accessories, a Mumbai-based D2C travel accessories provider, has raised $7 Mn in Pre-Series A funding from Sixth Sense Ventures and Volrado Venture Partners – Read More

Ensuredit, a Bengaluru-based insurtech firm, has raised $4 Mn in pre-series A funding from Cover Genius, 9Unicorns, NexStep Discovery, CP Ventures, Venture Catalysts and IPV – Read More

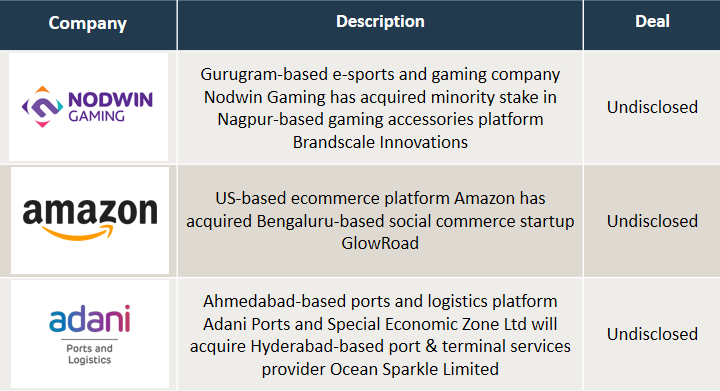

M&A Snippets

Bengaluru-based natural colors supplier Oterra has acquired Kerala-based natural ingredients manufacturer Akay Group for an undisclosed amount – Read More

Mumbai-based warehousing and fulfilment services provider Emiza Supply Chain Services has acquired Gurugram-based shipping solutions provider Shippigo for an undisclosed amount – Read More

We welcome Ms. Soniya Shivhare as an Associate at Ecosystem Ventures.

We welcome Ms. Soniya Shivhare as an Associate at Ecosystem Ventures.

We welcome Mr. Manish Malhotra as Management Trainee at Ecosystem Ventures.

We welcome Mr. Manish Malhotra as Management Trainee at Ecosystem Ventures.

We welcome Mr. Shailendra Prajapati as Management Trainee at Ecosystem Ventures.

We welcome Mr. Shailendra Prajapati as Management Trainee at Ecosystem Ventures.

We welcome Ms. Saloni Guptaas Business Analyst at Ecosystem Ventures. Prior to joining us, she has worked with Rippes Advisory as Training Manager, Pinnacle Market Investment Advisory as Research Analyst and Swastika Investmart Ltd. as an Associate.

We welcome Ms. Saloni Guptaas Business Analyst at Ecosystem Ventures. Prior to joining us, she has worked with Rippes Advisory as Training Manager, Pinnacle Market Investment Advisory as Research Analyst and Swastika Investmart Ltd. as an Associate.

We welcome Mr. Gautam Jain as Sr. Business Analyst at Ecosystem Ventures. Prior to joining us, he has worked with Knowcraft Analytics as Advanced Analyst, SG Analytics as Associate Analyst and Finmen Advisory as Jr. Analyst.

We welcome Mr. Gautam Jain as Sr. Business Analyst at Ecosystem Ventures. Prior to joining us, he has worked with Knowcraft Analytics as Advanced Analyst, SG Analytics as Associate Analyst and Finmen Advisory as Jr. Analyst.

We welcome Mr.

We welcome Mr.

We’re thrilled to announce that Mohit Bansal, an IIM Ahmedabad alumnus, has joined Ecosystem Ventures as a Partner. A seasoned entrepreneur with 19+ years of professional experience, Mohit has not only built India’s first online tutoring company, Learning Hour, which was acquired by Educomp Solutions in a multimillion-dollar deal but also was part of the founding team that built India’s first real money poker website Adda52.com.

We’re thrilled to announce that Mohit Bansal, an IIM Ahmedabad alumnus, has joined Ecosystem Ventures as a Partner. A seasoned entrepreneur with 19+ years of professional experience, Mohit has not only built India’s first online tutoring company, Learning Hour, which was acquired by Educomp Solutions in a multimillion-dollar deal but also was part of the founding team that built India’s first real money poker website Adda52.com. We welcome Mr.

We welcome Mr.

We’re elated to announce that Ravi Ajmera, IIT Delhi and Weatherhead School of Management Cleveland, USA, has joined Ecosystem Ventures as a partner.

We’re elated to announce that Ravi Ajmera, IIT Delhi and Weatherhead School of Management Cleveland, USA, has joined Ecosystem Ventures as a partner.

We are happy to share that we were part of the Udyamita 2022, an event which was conducted by Prestige Institute of Engineering, Management & Research (PIEMR). Mr. Paresh Y Murudkar (AVP, Ecosystem Ventures) represented the jury at the event.

We are happy to share that we were part of the Udyamita 2022, an event which was conducted by Prestige Institute of Engineering, Management & Research (PIEMR). Mr. Paresh Y Murudkar (AVP, Ecosystem Ventures) represented the jury at the event. Fintech lender Kinara Capital secures Rs 380 Cr in equity led by Nuveen

Fintech lender Kinara Capital secures Rs 380 Cr in equity led by Nuveen VideoVerse raises $46.8M in Series B led by A91 Partners, Alpha Wave Global

VideoVerse raises $46.8M in Series B led by A91 Partners, Alpha Wave Global