India’s Digital Credit Landscape: Thriving Leaders and Evolving Challengers

The Indian financial ecosystem is undergoing a seismic transformation, primarily driven by the rapid proliferation of digital credit platforms. With an estimated surge in digital payment users, surpassing key global economies, India is at the forefront of a digital credit revolution. As the digital consumer lending sector is projected to reach a staggering $720 billion by 2030, the stage is set for a fierce battle among key players to dominate this burgeoning market.

The digital consumer lending landscape has undergone a significant transformation, revolutionizing the way individuals access financial services. Consumer lending space can be segmented into four sub-categories: Personal Loan, BNPL, Gold Loans, Retail Cards.

1. Personal Loans have gained substantial traction, providing consumers with flexible financing for diverse needs such as medical emergencies, home renovations, or education expenses. For instance, platforms like Credible and SoFi have emerged as prominent examples, offering convenient and streamlined personal loan services.

2. Additionally, the ‘Buy Now, Pay Later’ (BNPL) concept has swiftly gained popularity, allowing consumers to make purchases and pay for them in installments. Companies such as Afterpay and Klarna have become frontrunners in the BNPL sector, catering to the growing demand for flexible payment options.

3. Moreover, Gold Loans have continued to serve as a reliable source of quick financing, with institutions like Muthoot Finance and Manappuram Finance leading the way in providing secure and accessible gold-backed lending solutions.

4. Furthermore, Retail Cards have become increasingly prevalent, empowering consumers with convenient credit options for their everyday shopping needs. Notably, the SBI Card and HDFC Bank’s EasyEMI are among the prominent retail card examples, offering users tailored benefits and rewards for their spending.

In this era of dynamic digital transformation, building a customer-centric organization has become a non-negotiable prerequisite for businesses in India. As consumer preferences evolve and technology continues to revolutionize various industries, companies must swiftly adapt to customer-centric strategies to maintain their competitive edge. Embracing customer data, implementing omni-channel strategies, personalizing experiences, prioritizing superior customer service, nurturing a customer-centric culture, and adopting agile methodologies have emerged as key pillars for organizations striving to be customer-centric in the digital age.

The rapidly evolving digital credit landscape in India presents both remarkable opportunities and intense competition. As the nation embarks on a journey of financial digitization, the key to success lies in understanding and catering to the ever-evolving needs of the Indian digital consumer, while simultaneously fostering a customer-centric ethos across all organizational levels.

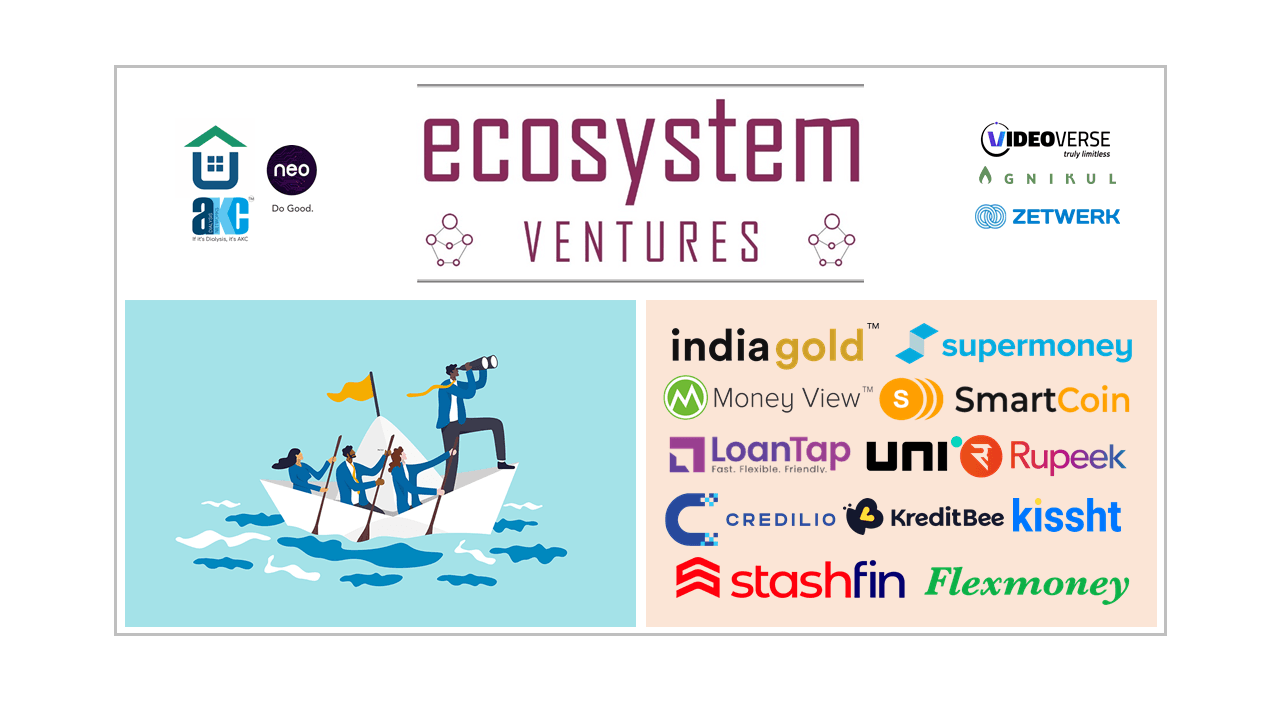

Startup Funding Summary

Zetwerk, Bangalore-based B2B ecommerce company, has raised $120 Mn in Series F funding from Avenir Growth Capital, Footpath Ventures, Greenoaks Capital, Steadview Capital, D1 Capital and Lightspeed – Read More

Neo, Mumbai-based wealth & asset management startup, has raised $35 Mn in a funding from Peak XV Partners – Read More

Vastu Housing Finance, Mumbai-based fintech company, has raised $30 Mn in a funding from Faering Capital – Read More

Agnikul Cosmos, Chennai-based spacetech startup, has raised $27 Mn in Series B funding from Celesta Capital, Rocketship.vc, Artha Venture Fund, Artha Select Fund, Mayfield India, Pi Ventures and Speciale Invest – Read More

Apex Kidney Care, Mumbai-based healthcare startup, has raised $10 Mn in a funding from Tata Capital Healthcare Fund II – Read More

M&A Snippets

Mumbai-based video editing platform VideoVerse has acquired LosAngeles-based AI-based audience enhancement Optikka for an undisclosed amount – Read More

Comments are closed.